1 Classification and strategy of sustainability at SZKB

Schwyzer Kantonalbank (SZKB) is an independent institution under Cantonal public law and wholly owned by the Canton of Schwyz. Founded in 1890, SZKB conducts the business of a universal bank. The central pillars of its existence are defined in the Cantonal Law on the Schwyzer Kantonalbank (current version as of 17 February 2010). Section 3(2) provides that: «It [SZKB] contributes to balanced and sustainable development of the Canton, taking particular account of the needs of the people living in the Canton, the economy and the public sector.» Section 9 of the Act also defines the geographical reach of the operations of SZKB: «The geographical scope of business primarily includes the Canton of Schwyz (Section 9(1) of the Schwyzer Kantonalbank Act). «Business in the rest of Switzerland and abroad is permissible if the Bank does not incur any disproportionate risks and the satisfaction of the money and credit needs within the Canton is not impaired by this activity (Section 9(2) of the Schwyzer Kantonalbank Act). «As a rule, the Bank’s foreign assets may not exceed 5% of the total balance sheet (Section 9(3) of the Schwyzer Kantonalbank Act).

SZKB’s head office and all of its branches are located in the Canton of Schwyz.

Annual Report

The Annual Report also includes the SZKB Management Report, Corporate Governance Report and Annual Financial Statements. It presents the economic situation of the Bank. The Annual Financial Statements include, in particular, the Balance Sheet, the Income Statement, the Cash Flow Statement and the Statement of Changes in Equity. The Annual Report also provides information on the Bank’s corporate structure (organisational chart), business activities, corporate governance, risk management and the remuneration of the Bank Council and the Executive Board.

Sustainability Report

The Sustainability Report includes reporting on non-financial matters pursuant to Article 964a et seqq. of the CO and was drawn up in accordance with the GRI Standards. Climate reporting, which is based on the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD), is presented in a separate chapter. Together with the Annual Report, the Sustainability Report provides a comprehensive picture of the financial, social and environmental dimensions of SZKB’s business activities.

The Sustainability Report 2024 was approved by the Executive Board on 4 February 2025 and adopted by the Bank Council on 13 February 2025 for the attention of the Cantonal Council of Schwyz.

SZKB’s Sustainability Report was not subjected to an external audit. It was published on 18 March 2025.

Unless specified otherwise, all information in this Sustainability Report pertains to the 2024 financial year, which spanned from 1 January to 31 December 2024. This report contains forward-looking statements based on expectations and assumptions. Various influencing factors may cause the actual results to differ from the estimates provided here.

Contact in case of questions about sustainability reporting:

Schwyzer Kantonalbank

Michelle Peter

Sustainability Expert

+41 58 800 2546

michelle.peter@szkb.ch

In 2023, the Executive Board and the Bank Council approved a sustainability strategy, verified the key topics and defined sustainability targets. In order to implement the sustainability strategy on an operational level, a specialist unit charged with achieving sustainability within corporate development was set up at the start of 2024 and the ESG programme was put into operational mode. A Sustainability Commission was also set up as a strategic management and decision-making committee at the start of 2024, which meets quarterly and in which the entire Executive Board and selected persons from existing commissions and departments are represented as members. This further development in sustainability governance ensures that regulatory requirements relating to sustainability are met and that strategic measures within the sustainability strategy are implemented. The interdisciplinary Sustainability Commission also incorporates the issue of sustainability into the various departments and business processes of Schwyzer Kantonalbank.

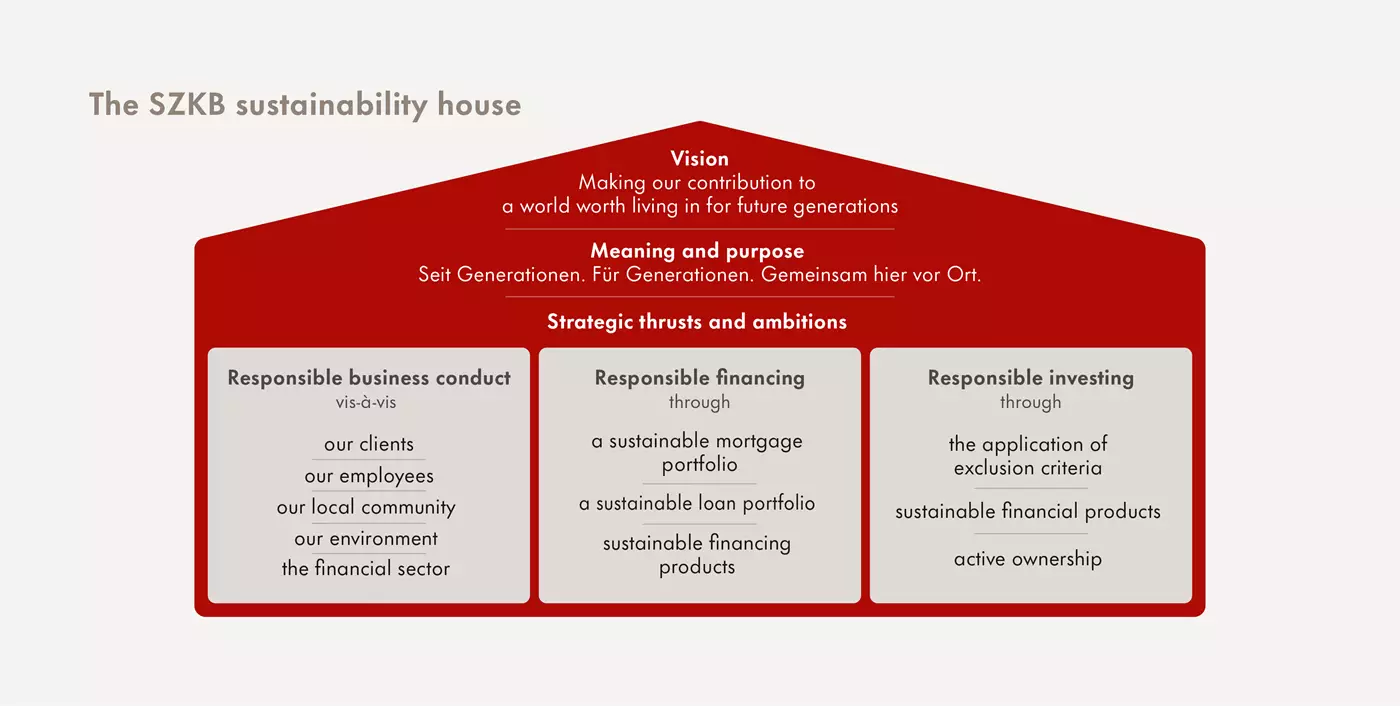

SZKB’s sustainability strategy, as defined by the Bank Council in 2023, comprises the following components:

- The SZKB sustainability vision

- The SZKB sustainability house

- The key topics

- SZKB sustainability ambitions and objectives

The SZKB sustainability vision

SZKB defined the following sustainability vision for 2023: «We are aware that the decisions we make today will have an impact on future generations. We are therefore dedicated to ensuring a sustainable future. We foster environmentally conscious behaviour and assist our clients in developing their assets and businesses in a sustainable manner. We strive to use resources efficiently, seek environmentally friendly solutions and make a positive social impact. By taking sustainability into account in all our activities, we are contributing to the preservation of a liveable world for future generations.»

The SZKB sustainability house

The sustainability house is the graphic representation of the sustainability strategy as a whole. The Sustainability Report is organised along the lines of the strategic thrusts.

The key topics

The key topics are the focus of SZKB’s sustainability reporting. These were determined according to the principle of dual materiality, meaning they are those topics where the Bank has the greatest impact on society, the environment and the economy (inside out), as well as those topics that have a (financial) impact on the Bank (outside in).

The key topics were identified in the following manner: As a starting point, SZKB drew upon industry analyses, sustainability ratings, stakeholder input and media reports to compile possible topics specific to the industry, Bank, and Canton and then have the effects assessed and analysed by internal Bank experts. The assessment of the key sustainability issues was updated in 2023 by SZKB technical experts with the involvement of people from the stakeholder groups clients, employees, Executive Board, Bank Council and Canton (Cantonal Supervisory Commission) and discussed with and approved by the Executive Board and the Bank Council.

Overview of key topics:

| Key topics | Addressed in the report/chapter |

| • “Client satisfaction” | Sustainability Report: Responsible business conduct |

| • “Data protection/client data/privacy” | |

| • “Diversity and integration” | |

| • “Remuneration of the highest governance bodies” | |

| • “Generations and local commitment” | |

| • “Fostering the local community and economy” | |

| • “Energy consumption and efficiency (greenhouse gas emissions)” | |

| • “Regulatory compliance” | |

| • “Reputation” | |

| • “Healthy growth” | |

| • “Financing a sustainable property” | Sustainability Report: Responsible financing |

| • “Access to sustainable financial services” | |

| • “Sustainable products and services” | Sustainability Report: Responsible investing |

| • “Commercial traffic/commuter traffic” | Sustainability Report: Climate Report |

| • “Climate change”, responsible financing | |

| • “Climate change”, responsible investing |

The list of key topics included in the 2024 Sustainability Report does not differ from those published in the 2023 report.

The materiality analysis identified additional topics beyond the key topics. These have been classified as non-key individual topics and are only included within key topics where necessary and in the relevant contexts.

| Other topics from the materiality analysis | Allocation |

| • Innovation | Responsible investing Business conduct |

| • Equal pay | |

| • Gender equality | |

| • Equal opportunities | |

| • Work-life balance | |

| • Employee development | |

| • Financial literacy informational event for the community | |

| • Volunteering | |

| • Sponsorship | |

| • Fairness towards competitors and suppliers | |

| • Sustainable procurement/supply chains | |

| • Protection of human rights | |

| • Independence of governance bodies | |

| • Political influence | |

| • Separation of powers | |

| • Responsible business conduct | |

| • Diversity and composition of the highest governance bodies | |

| • Combating corruption | |

| • Biodiversity | |

| • Recycling and waste management | |

| • Water consumption |

SZKB sustainability ambitions and objectives

The sustainability ambitions and the corresponding objectives, as well as the progress made in the achievement of the objectives, are set out in the following table.1

| Focus | Sustainability ambitions and objectives | Status | Comments on target status as of the end of 2024 | Chapter | |

| Responsible business conduct | Sustainability ambition: “We stand for a conscientious company that acts in accordance with the best of its knowledge and beliefs. As a bank, we acknowledge our responsibility to our stakeholders. We strive to enhance overall trust in the financial sector and ensure the satisfaction of our clients and employees through our responsible operating practices, which reflect the results of specific measures taken. It is also important for us to recognise and reduce our negative impacts on the environment. Ultimately, we want to support local projects in making a positive contribution to society.” | 1. Classification | |||

| 1 | … towards our clients | In the client satisfaction survey conducted every two years, 95% of clients express satisfaction or high satisfaction with SZKB. | Target achieved | The figure in 2024 was 95%. | 2.1 Responsible business conduct towards our clients |

| 2 | … towards our clients | In the client satisfaction survey conducted every two years, from 2030 onwards at least 70% of clients will say that they perceive SZKB as a sustainable or very sustainable bank. | Target achieved | The figure in 2024 was 79%. | 2.1 Responsible business conduct towards our clients |

| 3 | … towards our clients | By 2030, all branches will be accessible to clients with reduced mobility. | on track | As part of the branch concept, SZKB carries out an analysis with the aim of improving the accessibility of branch buildings to ensure that SZKB branches are accessible to clients with reduced mobility. | 2.1 Responsible business conduct towards our clients |

| 4 | … towards our clients | All SZKB full-time and part-time employees, as well as all authorised representatives with access to SZKB’s IT systems, are required to complete annual online training courses on data and information security to ensure the security of client data. | Target achieved | SZKB employees complete annual online training on data and information security. 100% of those invited to participate completed the training. External employees with access to SZKB systems were provided with appropriate information by the relevant SZKB employees or by SZKB specialist units. | 2.1 Responsible business conduct towards our clients |

| 5 | … towards our employees | SZKB fulfils its role as a training company by providing a number of apprenticeship and internship positions equivalent to a minimum of 5% of the workforce. | Target achieved | In 2024, SZKB offered apprenticeships and internship positions to a total of >5% of the workforce. In 2024, SZKB increased the number of apprenticeships and introduced two new occupational profiles. | 2.2 Responsible business conduct towards our employees |

| 6 | … towards our employees | The number of sickness-related absence days per employee (FTE) is less than 5.0 days per year. | on track | 2024: 4.5 days of absence due to illness per employee (including long-term absences) | 2.2 Responsible business conduct towards our employees |

| 7 | … towards our employees | SZKB acts as a socially responsible employer by providing job opportunities for individuals with disabilities, such as through reintegration programs or through the continued employment of employees with limited capacity, with at least 1% of its employees taking advantage of such opportunities. | on track | SZKB is actively involved as a social employer and focuses on ensuring sustainable employment conditions for employees, including in the event of illness or limited capacity for work. | 2.2 Responsible business conduct towards our employees |

| 8 | … towards our employees | By 2030, reduction in greenhouse gas emissions from transportation (Scope 3) in accordance with Swiss climate strategy (reduction of 21% compared to reference year 2021). | on track | Further measures, such as a preliminary study on a mobility concept, will be developed in order to achieve objectives. | 5 Climate Report |

| 9 | … towards our employees | The (unexplained) pay gap between the genders is no more than 2.5%. | Target achieved | The (unexplained) pay gap between the genders is lower than 2.5%. The analysis is carried out every two years and the figure reported relates to the 2023 analysis. | 2.2 Responsible business conduct towards our employees |

| 10 | … towards our employees | By 2030, there will be a minimum of 25% representation of both genders among employees at all levels, including the Executive Board. | on track | In 2024, SZKB was able to achieve the target representation of at least 25% of each gender at almost all levels. The proportion of women was below the 25% target, at 14.3% on level 8 and at 24.6% on level 6. | 2.2 Responsible business conduct towards our employees |

| 11 | ...towards our local environment | Local commitment (sponsorship) of at least CHF 0.8 million per year | Target achieved | SZKB awarded CHF 0.8 million in the form of sponsorship in 2024. | 2.3 Responsible business conduct towards the local environment |

| 12 | ...towards our local environment | Increase the number of financial literacy events hosted. | Target achieved | The target of increasing the number of financial literacy events was achieved through the introduction of public events such as "Clever@SZKB". This initiative has focused on awareness of financial education and is aimed at a broad target group. | 2.3 Responsible business conduct towards the local environment |

| 13 | ...towards our local environment | By 2027, SZKB will reduce its operational CO₂ emissions by 15.8%, or 145 t (base year 2021), to 770 t.. | on track | SZKB’s CO₂ emissions rose by 54.4 tonnes compared to 2022 to 1,050.5 tonnes in 2023. The main reasons for this were increased emissions from refrigerant losses, IT equipment purchases and the increased headcount. Emissions from IT equipment were caused by planned infrastructure renewal (e.g. emissions in the base year: 54.2 tCO₂). | 5 Climate Report |

| 14 | ...towards our local environment | Raising employee awareness of resource consumption (e.g. paper, heating, light and electricity). | Target achieved | Awareness has been raised through various channels such as an EB update call or an intranet notification. | 2.4 Responsible business conduct towards our environment |

| 15 | ...towards our local environment | By 2030, all bank buildings (solely) owned by SZKB will cease using oil or gas heating systems, provided that it is economically feasible and technically viable to do so. | on track | Ongoing conversion according to the Masterplan 2030 to more environmentally friendly heating systems at branch properties (solely) owned by the Bank. | 2.4 Responsible business conduct towards our environment |

| 16 | ...towards our local environment | By 2030, SZKB will have installed photovoltaic systems on all bank buildings (solely) owned by SZKB, provided that it is economically feasible and technically viable to do so. | on track | Installation of photovoltaic systems according to the Masterplan 2030 | 2.4 Responsible business conduct towards our environment |

| Responsible financing | Sustainability ambition: "We promote sustainable financing. As a bank, we recognise our role within society as an enabler of the development of sustainable activities. We are committed to expanding access to sustainable financial services for private and professional clients while integrating environmental and social criteria into our financing solutions. We also would like to reduce the greenhouse gas emissions of our financing portfolios and achieve net zero emissions by 2050." | 1. Classification | |||

| 17 | Sustainable mortgage portfolio | The emissions intensity of mortgages2 financed will be reduced by a minimum of 42% by 2030 compared to the 2022 base year. | not on track | SZKB is developing measures to reduce the emissions intensity of mortgages financed. In addition to raising awareness among property owners and employees, the Bank plans to develop financing products that foster and support sustainable behaviour on the part of mortgage borrowers. The integration of sustainability risks into risk management will also become more significant. | 5 Climate Report |

| 18 | Sustainable mortgage portfolio | By 2030, the emissions intensity of commercial real estate financed will be reduced by a minimum of 40% compared to the 2022 base year. | not on track | SZKB is developing measures to reduce the emissions intensity of commercial property. In addition to raising awareness among clients and employees, the Bank plans to develop financing products that foster and support sustainable behaviour. The integration of sustainability risks into risk management will also become more significant. | 5 Climate Report |

| 19 | Sustainable loan portfolio | Development of financing products that foster and support sustainable behaviour. | on track | Introduction of solutions for energy-efficient renovation for private clients. A solution for commercial clients is also being planned. | 3 Responsible financing |

| 20 | Sustainable loan portfolio | Raising awareness among clients. | Target achieved | The advice given to clients actively considers ESG issues and raises their awareness at the same time. | 3 Responsible financing |

| 21 | Sustainable financing products | Raising awareness among employees. | Target achieved | Employees have received general ESG training through various programmes, including product-specific training focusing on ESG and sustainable financing products. | 3 Responsible financing |

| 22 | Sustainable financing products | Creation of incentives (e.g. favourable interest rates) for a reduction in emissions intensity. | Target achieved | Advantageous conditions for energy-efficient renovation with the "handshake mortgage". | 3 Responsible financing |

| 23 | Sustainable financing products | Support with the generational transfer of a property | Target achieved | Introduction of the solution for advising multiple generations, providing support with the generational transfer of a property. | 3 Responsible financing |

| Responsible investing | Sustainability ambition: "We promote sustainable investments. As a bank, we recognise our duty to manage our clients’ assets responsibly with a long-term focus. We are committed to systematically incorporating sustainability aspects into the development of all our portfolios in order to manage sustainability risks. At the same time, we want to offer our clients sustainable products that align with their ESG preferences and expectations. Ultimately, we see ourselves as representatives of our clients in regard to all investment recipients and seek to work towards more sustainable business development on their behalf." | 1. Classification | |||

| 24 | Application of exclusion criteria | Consideration of controversial and/or environmentally harmful sectors in the investment decision-making process. | Target achieved | Extreme risks are also excluded within traditional investment solutions. | 4 Responsible investing |

| 25 | sustainable financial products | By the end of 2025, at least 20% of asset management mandates should have client preferences that are aware, focused or effective, and by the end of 2030, this should increase to at least 50% of all asset management mandates. | Interim target achieved | As of the end of 2024: 36.3% | 5 Climate Report |

| 26 | sustainable financial products | The proportion of SZKB investment funds with alignment with client preferences of aware or focussed will be at least 20% of the total of all SZKB investment funds at the end of 2025, and this proportion will increase to at least 50% by the end of 2030.3 | Interim target achieved | As of the end of 2024: 43.3% | 5 Climate Report |

| 27 | sustainable financial products | Development of further financial products that foster sustainable behaviour and thus correspond to various ESG preferences. | Target achieved | In 2024, SZKB introduced a new ESG line, thus expanding its range of sustainable products at the portfolio management and asset management level in order to cater to various needs. | 4 Responsible investing |

| 28 | Active ownership | Development of an engagement policy by 2025. | Target achieved | In 2024, SZKB carried out an analysis of various proxy voting and collaborative engagement solutions. As a result, it decided that its active ownership policy will include the Ethical Fund’s proxy voting solution. | 4 Responsible investing |

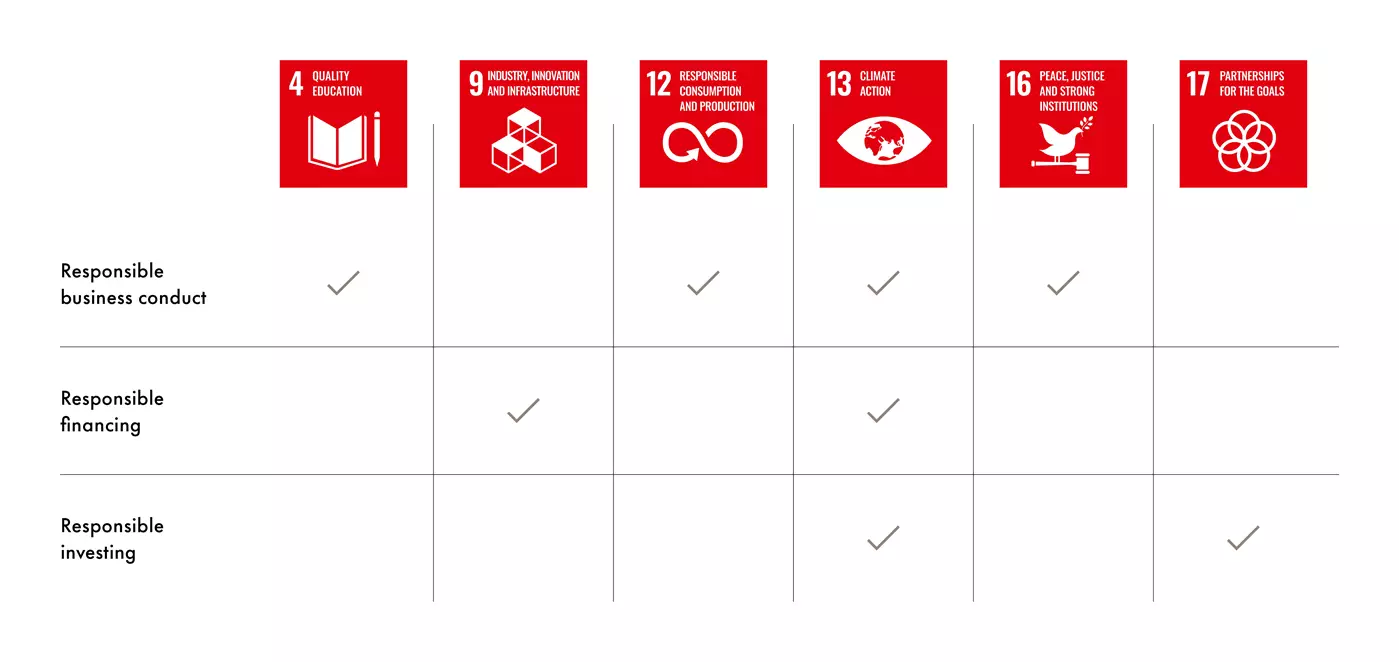

SZKB’s approach to sustainability is based on the 17 United Nations Sustainable Development Goals (SDGs). SZKB is committed to all 17 SDGs but focusses its activities on six of them in particular in order to achieve the greatest possible impact.

1 All targets, including in particular quantitative CO2 emissions targets, are aligned with the objectives of the Swiss Climate Strategy (Federal Office of Energy FOE: Energy perspectives 2050+: Development of greenhouse gas emissions).

2 Financed mortgages include single-family houses and individual flats.

3 This is a volume figure (AuM).

In 2024, SZKB made significant progress in implementing its comprehensive sustainability strategy and considers it to be effective and expedient. The respective management approaches and the main measures are listed in the individual chapters of this Sustainability Report.

- Thanks to the introduction of clear sustainability governance, competences and responsibilities in the area of sustainability within SZKB have been delineated. A key component here was the establishment of the Sustainability Commission which, as a strategic body, sets the course for future ESG activities and monitors the achievement of strategic objectives.

- Internal know-how has been further developed through various ESG training courses. The awareness and expertise of employees in the areas of environment, social affairs and governance have been enhanced in a targeted manner. Some of the training sessions were held with external partners and universities.

- The range of sustainable products in the areas of finance and investing has been expanded. This enables SZKB to offer solutions to its clients that meet their ESG needs.

- SZKB is increasingly being confronted with dynamic regulatory requirements in the area of sustainability, which will also have a significant impact on tasks and measures in the area of sustainability in the coming years. At the same time, ESG regulations also offer the opportunity to continuously adapt and further develop processes in order to meet both legal requirements and the expectations of our clients.

- Other measures for implementing the sustainability strategy described in this report are also planned for 2025 and subsequent years.